Which internet site do you recommend to determine the truth of something?

I disagree with this. For us retail investors, we maybe, a remote maybe, might get 1 or 2 pieces of “inside info” that we can profit from in our lives. Many of us will get zero inside info. And “if” we get that profitable inside info, chances are we don’t have enough principal capital to invest to get a meaningful benefit from it. But I did pretty dang good, once over a 40% annual return when I was swing trading. Sometimes I would hold a company for 30 minutes & dump it after a 7% gain. Inside info isn’t as good as some folks make it sound imo, at least for us small fry retail investors.

Aslo, I don’t know what you mean about charging a fee, being free & immunity cert?

All those curious about congress and stock trading can look up who’s trading. One of the more prolific recent ones is a wealthy freshman congressman from Pennsylvania Rob Bresnahan who campaigned to stop trading by congress and said he would introduce a bill to stop it. Needless to say he hasn’t introduced a bill. They all do it even the ones that complain about Pelosi. Look up your congress critter and follow along. Keep in mind some file disclosures very late

The $US will crash. As will the stock market. Don’t hold cash (more than you need to get by). Your bank savings are not guaranteed (regardless of what they say).

My bet is physical gold and silver will store value having been suppressed for years because the central bankers wish to devalue it and encourage holdings valued in $US.

Add any other tradable physical items or stores of value. The best survival mechanism is self sufficient communities of like minded people eg farming with your own supplies of food and water.

Good to have old tech stuff that has worked forever instead of modern stuff with computer chips, internet connectivity and the ability of Big Government to switch it off remotely. Got a good old car you can fix instead of the ones that lecture you to slow down and steer and brake when you don’t decide to do that?

Ammunition and alcohol might be good to hoard if the coming apocalypse is what has been promised. You’ll find its value will grow with the hard times ahead. Plenty more you can decide yourself.

To repeat, gold and silver will grow and they are tradeable without your government’s intervention. Your wheelbarrow of $US currency will still buy a loaf of bread. There have been precedents, remember?

Lowering the USD is part of the master plan to rehome manufacturing and reduce imports.

Thanks for your opinion but I heard the same exact speech about gold from several shipmates in the Great Recession & during the first months of the pandemic in '20. I’m glad I bought real estate & equities instead. And as far as I can tell, those on the “Buy Gold” bandwagon really never aquire any large amounts of gold. I never heard any one claim they owned $700k in gold but know dozens of folks who are multi millionaires via properties, 401k’s & stocks. Plus properties, 401k’s & taxable brokerage accounts pays rents & dividends that we can live off of or reinvest. Those with gold, (like me with guns), never sell nor earn a penny from it. I guess they’ll die with their gold, lose it in divorces or wait until the end of the world to try to trade it for cans of Spam which makes little sense because Spam is cheaper right now?

Note I also recommend physical ‘stores of value’ which includes real estate (including farms). So good to see we agree thus far.

I’m simply hearing that fiat currencies, the principal of which is the $US, will all fail simply because they are based on nothing other than government promises that this piece of paper is worth a dollar. It isn’t, BUT it was prior to Breton Woods when it could be exchanged for gold.

The Ponzi scheme of never ending borrowing to support the currency is very near to ending. Gold will likely return to be the basis of currency but the transition will be traumatic.

My bet; gold will be the best tradable, physical store of wealth during that trauma.

When shipmates start talking up gold I usually give them a hypothetical scenario during a real world event. Here goes.

Question: Imagine it’s late March 2020, & 3 different dads go to the local grocery store in (I say my town) on such-&-such street (I use a real street in my town). They all want to buy diapers, milk & bread. 1 dad has cold hard cash, the second dad has a loaded gun & the third dad has a small pouch full of gold coins. Who walks out of the grocery store with the diapers, milk & bread??

Answer: No one. My wife was at that grocery store in late March 2020 & they didn’t have any diapers, milk or bread.

Conclusion: Anyone who owns guns, diapers, milk & bread will be able to trade for anything they want. But if things get as bad as gold hoarders fear, no one is going to want their shiny pieces of yellow metal. Diapers & coffee would be more valuable than gold.

Buy Bitcoin or other crypto they’re not fiat currencies! It’s a store of value like gold according to the current US Sec. of Treasury.

golds a store of wealth against inflation ( but no interest)

check history to see what 1oz buys today and over a 100 years

1923 a tailored suit, buys same suit today.

Yes. I agree fully. That’s in fact what I said without exactly spelling out the entire range of tradeable physical commodities.

But nobody has their wealth stored in those things. How big is your shed of these items? Gold is simply universal recognised as cash and it’s portable.

For a better explanation of why gold, try lasting through this.

You’d be surprised. With 2 teenagers I pay $1,100 every 6 months for auto insurance. I pay twice that amount annually for my primary residence property insurance. Just with those 2 insurances, that’s nearly $5k evaporated every year that thank God I never use (property insurance once). With my investment properties, health, life & disability insurance I pay over $14k a year in insurance. Once I became accustomed to watching that type of money just disappear every year for services I scarcely use for nothing in return except a sense of security, it was quite easy to drop a few grand on food reserves & staples in case of emergency. Not an investment to store wealth, just another form of insurance that is looked down upon by intellectuals who think they know better. Food & household staples are cheaper than gold. I would store wealth by building a bigger shed & storing cheaper food if I thought I needed to store wealth in expensive gold. If said emergency ever happened, possibly I would trade some of my stores for those yellow shiny pieces of metal for pennies on the dollar if I wanted?

I laughed when I read this. No one on this forum has been a bigger supporter of Cheeto jesus than you. Once CJ gets back in power everything will be all right, you said. America will be prosperous.

Now he’s back in power and you’re warning us America has become a destitute hellscape in less than four months of his rule.

You better watch out. They might kick you out of the cult for that.

Watched the You Tube video I posted yet?

Then respond.

Trump is powerful, but he doesn’t control everything. I remain a fan but haven’t got my membership card or even any merch. Got some funny ones though.

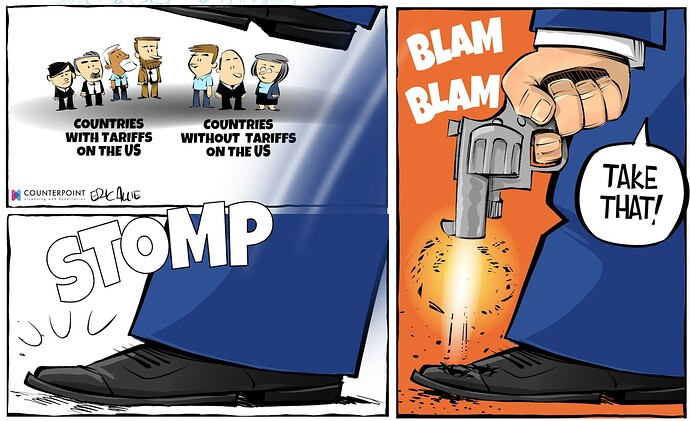

No additional text or comment required:

Source: Cartoons: Eric Allie for April 4, 2025 | The Patriot Post

Bank savings are insured; the catch is that FDIC has 99 years to pay you back.

Putting everything into Trump Steaks, Trump The Game, Trump Ice, USFL New Jersey Generals, Trump Magazine, Trump Vodka, Trump Shuttles, Trump World’s Fair, Trump Bibles, Trump Watches, Trump Guitars, Trump University, $Trump crypto, Melania Crypto, Fight Fight Fight Cologne, also trying to find betting odds in Vegas for the date when the check from Mexico for the wall will arrive.

From my observations from a few financial crises, the “BUY GOLD & GUNS!!!” negative nellies & emotional political train wrecks never make money during these awesome opportunities unless it’s just outright handed to them in the form of stimulus checks or welfare. I listed 4 links that show dozens of different assets now paying a 20% dividend yield because of the decline of their share prices & many of you folks still arguing political nonsense that you have absolutely no control over. It’s quite obvious to me why the emotional/dumb stays poor & the rich get richer.

Ok, I just did some quick math from 3 of the 4 links I provided & picked 7 CEF’s, 7 ETF’s & 7 individual stocks for a total of 21. Combined, their average dividend yield is 17.86%, meaning if you had $200k to invest/rebalance & bought $9k of each, you’d make $35,720 every year in income if their dividends stayed the same or increased. This strategy worked for me in 2021 when I relocated/sold many of the index funds I bought in March 2020. Only difference for me was I had a better return than 17.86% because I bought a lot of REIT’s that were in the dumps due to the moratorium on rent payments & on evictions. But after that was lifted I was clearing over 25% because I bought the REIT’s dirt cheap. Below are the CEF’s, ETF’s & stocks I did the math on. The symbols with * next to them are companies I already own.

Symbol. / Current Dividend Yield %.

CEF’s from CEF Channel:

BCAT. 25.04%

ECAT. 24.98%

CLM* 21.44%

CRF* 21.17%

XFLT* 17.21%

ACP* 17.10%

ETF’s from Just ETF’s:

UDIV* 12.35%

QYLE* 11.33%

TAEH. 8.80%

XY7D. 8.70%

EUNY. 8.56%

UEFS. 8.56

Stocks from Tradingview:

IFP* 24.24%

CATO. 24.11%

FA. 22.05%

VOC. 21.27%

XP. 20.25%

MNR. 20.24%

TPVG. 19.61%

A $35K annual return on a $200k investment is pretty dang good imo.

Who has 200k laying around