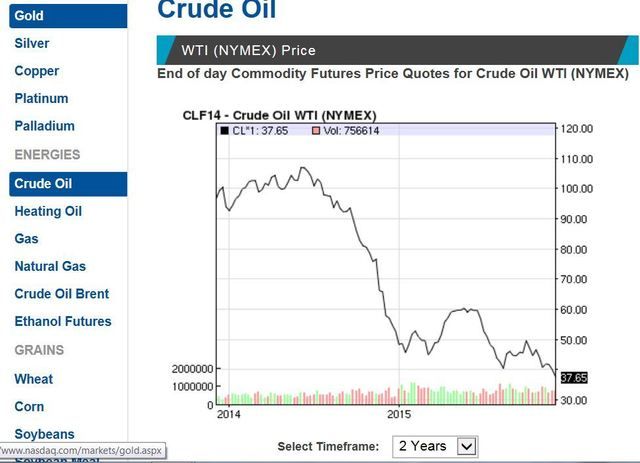

then there is this

[B]Goldman thinks oil prices could fall another 50% as the market spends another year sorting itself out[/B]

Dec. 4, 2015

The oil market is out of whack and Goldman Sachs doesn’t see this situation sorting itself out for another year.

In a note to clients on Friday following OPEC’s latest production announcement, Goldman’s Damien Courvalin wrote that the oil market’s supply-and-demand balance won’t be restored until the fourth quarter of 2016 at the earliest.

On Friday, OPEC — the 13-member oil cartel — announced that it will look maintain its current rate of production at around 31.5 million barrels per day. (Goldman, for its part, expects OPEC production to come in closer to 31.8 million barrels per day.)

OPEC also said it would discuss how to accommodate higher production out of Iran at its next meeting in June.

Goldman added that OPEC commentary, “further stressed the need for the oil market to rebalance on its own (‘wait and watch’) and the organization made no comment on adhering to country level quotas.”

This approach from OPEC, however, could send oil prices even lower as markets may still fail to clear oversupply.

Here’s Goldman:

[QUOTE]For now, our price forecast reflects our belief that “financial stress” can solve the current market imbalance by gradually reducing excess supply capacity as demand recovers. We believe, however, that there are high risks that this may prove too slow an adjustment as inventories continue to accumulate and storage utilization nears high levels in the face of a mild winter, slowing EM growth and a potential lift of international Iranian sanctions. The rising probability that markets may need to adjust through “operational stress,” when surpluses breach capacity, leaves risks to our forecast as skewed to the downside in coming months, with cash costs near $20/bbl."

And so while Goldman is forecasting oil prices over the next few months to be near $40 a barrel, or roughly where they are trading today, there could be another 50% to fall as continuing OPEC production pushes producers toward the absolute lowest level they can conceivably manage.

While much has been made of the “breakeven” cost of oil production over the last year, it is the “cash cost” that determines the actual floor for oil producers. The “breakeven” cost measures what oil price producers need to be profitable, the “cash cost” measures the absolute lowest level a producer can accept to keep their operation running (even if at a loss).

The strategy that has been employed by OPEC over the last few years as US shale production has ramped up has been to push ahead and seek to both bring in as much revenue as possible by simply selling oil at prevailing market prices and hoping to push out smaller, marginal producers as a result of these low prices created by an oversupplied market.

In other words, OPEC has been content to play chicken with US producers.

But as long as investors remain willing to invest in oil companies that are operating above their “cash cost” level, then it won’t be financial stresses on the company level that allow markets to clear, but stresses at the storage level that might be needed for the market to balance.[/QUOTE]

Like I said…JUST FUCKING WONDERFUL