[B]US oil settles down $1.75, or 5.28%, at $31.41 a barrel[/B]

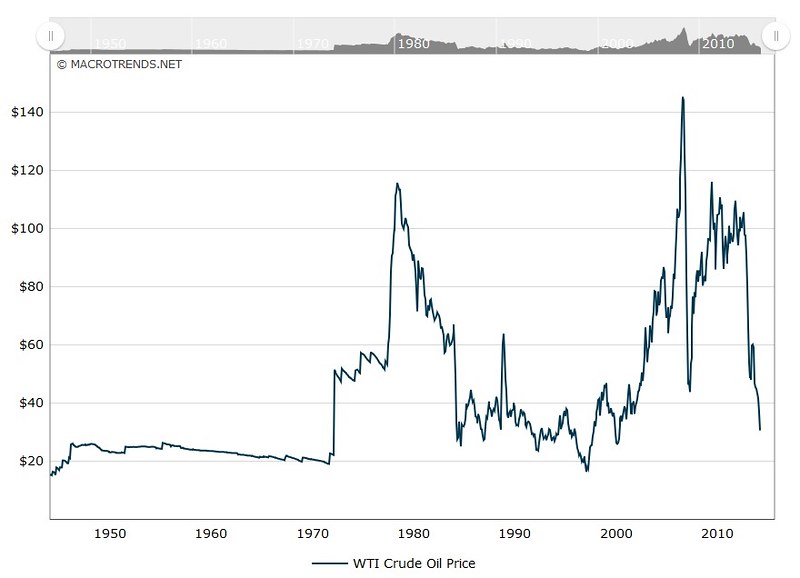

A brutal new year selloff in oil markets deepened on Monday, with prices plunging more than 6 percent to new 12-year lows as further ructions in the Chinese stock market threatened to knock crude into the $20s.

On Monday, China’s blue-chip stocks fell by another 5 percent and overnight interest rates for the yuan outside of China soared to nearly 40 percent, their highest since the launch of the offshore market.

Morgan Stanley warned that a further devaluation of the yuan could send oil prices spiraling lower still, extending the year’s nearly 15 percent slide.

While China’s ructions are spooking traders over the outlook for demand from the world’s No. 2 consumer, drillers in the United States say they are focused are keeping their wells running as long as possible, despite the slump, executives told a Goldman Sachs conference last week.

U.S. West Texas Intermediate (WTI) crude settled at $31.41 a barrel, down $1.75, or 5.28, having early fallen to $31.88, an intraday low going back to December 2003.

Brent crude futures were down by $1.99 at $31.56 a barrel, after falling to the lowest level since April 2004.

The markets are positioned in a way where “traders are afraid to be long,” said Clayton Vernon, a trader and economist with Aquivia LLC in New Jersey. “The firm push for normalization with Iran has taken the last shred of geopolitical risk out of traders’ minds.”

The European Union said on Monday that the lifting of sanctions on Iran could come soon, following a deal last year to curb the Middle East nation’s nuclear program. Many market participants that Iran’s return to the oil markets would add more pressure to the global glut that has knocked prices from more than $100 in mid-2014.

Even so, many big investors are still shifting more of their bets to the bearish side of the market. Speculators cut their net long position to the small since 2010 in the week to last Tuesday, with short positions rising in a sign that they are losing faith in a price rise any time soon.

“If the first week is anything to go by we are in for a long, volatile and very exhausting year. The week started on a bad note and ended on a good one but the market response, worryingly, was the same to both — sell, sell, sell,” David Hufton, of oil brokers PVM Oil Associates, wrote in a note.

“China has torpedoed the hopes of the optimists. The third leg of the financial crises involving emerging markets that the IMF, World Bank, BIS and various messengers of doom had warned of has come into play,” he said.

Goldman Sachs analysts, who have also said oil could hit $20 a barrel, said in a note on Friday that sustained lower prices were needed in the first quarter “so producers will move budgets down to reflect $40 a barrel oil for 2016.”

Oil prices have fallen over 70 percent since the downturn began in mid-2014 as soaring global production sees hundreds of thousands of barrels of crude produced every day without a buyer.

“If you actually look at how low (prices) need to go to hit variable-cost production, then you need a two-handle on crude and we could well be in that world now,” Citi head of energy research Seth Kleinman said.

“Q2 looks brutal. You could have refiners coming offline, just as Middle East production comes back online, including Iran.”

Adding to overproduction is slowing demand, especially in China where growth has dropped to its lowest rate in a generation and experts see few signs of improvement for the next few years.