The situation over at Transocean right now appears extraordinarily challenging… my thoughts:

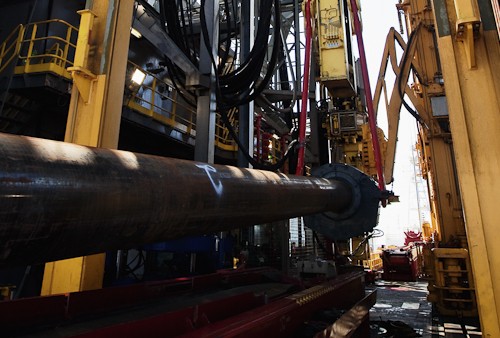

Running casing on the [I]Discoverer Clear Leader[/I], image © R. Almeida

Considering the 4.5 years of legal battles Transocean (NYSE:RIG) has facedsince the Deepwater Horizon tragedy, the involvement of activist investor Carl Icahn, and the now utterly abysmal offshore drilling market, the news in mid-February of then CEO Steven Newman’s abrupt departure wasn’t that big of a surprise. It did leave those of us standing on the sidelines wondering what was next however.

Transocean (NYSE:RIG), the world’s largest offshore drilling company will be reporting fourth quarter results on Thursday morning, but even before their earnings report was released, Moody’s downgraded Transocean’s senior note rating to junk status.

Why?

Nine of the company’s ultra-deepwater rigs including the [I]C.R. Luigs, Discoverer Spirit, GSF Jack Ryan, Deepwater Discovery, Deepwater Frontier, GSF Explorer, Deepwater Pathfinder[/I] and [I]Deepwater Expedition[/I] are currently out of work, while at least nine more ultra-deepwater rigs will be finishing up their contracts in 2015 – a number which doesn’t include the ultra-deepwater drillship [I]Discoverer Americas[/I]that sources tell gCaptain will be going off contract with Statoil in the next few months.

Losing their contract with Statoil will likely only keep the [I]Americas[/I] idle for a little while however, before she gets snatched back up by someone else under a new, yet much reduced day rate. A similar situation may be occurring with Transocean’s drillship [I]Deepwater Invictus, [/I]a rig that is currently earning $595,000 per day and is covered by a firm contract from BHP Billiton until 2017. A source tells gCaptain that she will likely be dropped by BHP Billiton and re-hired by Chevron under a much lower day-rate, while BHP signs up the [I]C.R. Luigs -[/I] a rig that is currently idle.

Using that same model of dumping expensive rig contracts and re-hiring, the contract for Transocean’s 6th Generation drillship [I]Discoverer Clear Leader (DCL)[/I][B][/B]could be in possible jeopardy as well. The DCL is on contract to Chevron until October 2018 at $590,000 per day and as a sister rig to the [I]Discoverer Americas,[/I] it’s certainly possible that Chevron will dump its current contract and sign up the [I]Discoverer Americas [/I]once she becomes available. I must state that this scenario is pure speculation at this point, however.