On Wednesday, January 23, I published an article entitled, “Seadrill: Pacific Drilling May Be Hard to Swallow with Money from Tender Rig Deal.” In this article, I concluded that the money that Seadrill (SDRL) is receiving from SapuraKencana in exchange for its tender rig division will be insufficient to finance a takeover of Pacific Drilling (PACD) as some shareholders have speculated. In order to finance this deal, Seadrill would either need to take on additional debt or issue new shares to fund this takeover. My fellow Seeking Alpha contributor Steven Breazzano asked in the comments to this article what the effect of issuing more shares would be should Seadrill try to fund a takeover deal in this way. As I feel that this question deserves an in-depth response, this article is the result.

In my previous article, I proved several reasons why Pacific Drilling would be a tempting takeover target for Seadrill. I will spare you the details of that here. In short, Pacific Drilling has one of the most modern and technologically-advanced ultra-deepwater drilling fleets in the world today and this fleet would fit perfectly in with Seadrill’s.

As of September 30, 2012, the date of Seadrill’s last quarterly report, the company had 469,121,774 shares of common stock outstanding. If we assume that Seadrill is going to issue new shares to cover the portion of the acquisition that it cannot accomplish with the cash from SapuraKencana then this amount is obviously going to increase. But by how much? Ultimately, that depends on just how Seadrill is going to execute this deal. I will examine two different possibilities here in the hopes of answering Mr. Breazzano’s question as thoroughly as possible.

Seadrill expects to receive approximately $1.2 billion in cash from the sale of its tender rig division, so let’s begin our analysis there.

Case 1

In this case, we will assume that Seadrill simply uses all the cash from SapuraKencana to acquire Pacific Drilling at a 10% premium. We will assume that Seadrill floats additional equity to acquire all of the outstanding shares of Pacific Drilling after its initial $1.2 billion is exhausted. Seadrill will then assume all of Pacific Drilling’s liabilities as its own and will cover payments that Pacific Drilling owes SHI (Samsung Heavy Industries) for its new rigs.

At the time of writing, Pacific Drilling had a market cap of $2.26 billion. Therefore, the cost to Seadrill, in cash and stock at least, would be equal to Pacific Drilling’s market cap plus 10%, or $2.486 billion. Since Seadrill has $1.2 billion in cash to spend, the company will issue new shares with a total value of $1.286 billion. Seadrill’s stock price at the time of writing is $38.74, so approximately 3,300,000 shares will be issued to raise the necessary funds. The company will thus have a total of 472,421,774 shares outstanding following the takeover.

Case 2

In this case, we will assume that Seadrill uses all of the cash from SapuraKencana to acquire Pacific Drilling at a 10% premium. We will assume that Seadrill floats additional equity to acquire all of the remaining outstanding shares of Pacific Drilling after its initial $1.2 billion is exhausted. We will also assume that rather than take on all of Pacific Drilling’s liabilities as its own that the company instead floats additional extra equity to raise the necessary capital to pay off all of Pacific Drilling’s outstanding liabilities. This will increase the total number of shares outstanding by much more than the first case but it will also prevent Seadrill from taking on an oversized amount of debt. As this case will cause the greatest amount of share dilution, it should be considered a “worst case” scenario.

As previously mentioned, Pacific Drilling has a market cap of $2.26 billion. Thus, at a 10% premium, it would cost Seadrill $2.486 billion to buy all of the outstanding stock in the company. Since Seadrill is receiving $1.2 billion in cash from SapuraKencana, the company will have to float $1.286 billion worth of stock to acquire all of Pacific Drilling’s shares. In addition, Seadrill will need to float stock to pay off all of Pacific Drilling’s debts. As I mentioned in my previous article, Pacific Drilling has $1.866 billion in short- and long-term debt and also has $1.72 billion in shipyard payments coming due between now and 2015. In order to cover all of this, Seadrill would have to float an additional $3.586 billion worth of stock which is equal to about 9,260,000 shares at the current stock price. Thus, the grand total of shares outstanding following the new issues in this case is 481,681,774.

Now, in order to determine the effect that all of these new shares will have on current shareholders, we need to get some idea of what the combined company would look like. I will keep this simple and just assume that the resulting company will have cash flows similar to the combined totals of both firms individually. In truth, redundant functions and the like could be eliminated which could lead to higher cash flow but I will keep this simple.

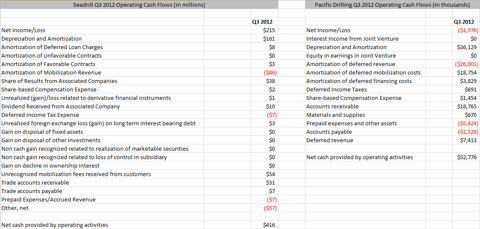

Here is the Cash Flow from Operations section of each company’s statement of cash flows:

(click to enlarge)

Source: International Hedges

As you can see from the chart, Seadrill had operating cash flow of $413 million in the third quarter of 2012. Pacific Drilling, meanwhile, had total operating cash flow of $52.78 million during the same period. Thus, by using the assumptions that we already made, the combined company would have total operating cash flow of approximately $465.78 million per quarter.

This would work out to total OCF per share of $0.99 in the first case and $0.97 in the second. Prior to issuing new shares, Seadrill had OCF per share of $0.88. Therefore, this transaction would generate value for shareholders in both cases.

This is important because Seadrill bases its dividend on the company’s operating cash flow per share and, of course, to determine the impact on shareholders. In this case, it does appear that Seadrill could hike its dividend significantly following this transaction.

This does not tell the full story, however. In order to obtain the aforementioned money from SapuraKencana, Seadrill will be selling its entire tender rig division. The combined company will therefore not have any of these rigs nor the cash flow generated by them. Seadrill unfortunately does not state how much operating cash flow this rig division generates. However, I calculated an estimate of $99 million per quarter in a recent article.

Therefore, when all is said and done, the combined company would have total quarterly operating cash flow of $366.78 million. This works out to $0.78 per share in the first case and $0.76 per share in the second. This is less than Seadrill had to start [FONT=inherit]with. Therefore, shareholders would be quite disappointed with this transaction in the short- to medium-term. However, once all the newbuilds that the combined company would have come online and begin working, the deal will look much better.[/FONT]

Once again, I would like to reiterate that this is all speculation. Neither Seadrill nor Pacific Drilling has made any statement about a potential takeover nor has either company purchased equity in the other. Seadrill has stated that it intends to invest the money that it receives from SapuraKencana into either newbuilds or M&A intended to [FONT=inherit]grow its ultra-deepwater and jackup rig fleets. Therefore, this article is simply intended as a thought exercise and as speculation due to the potential synergies that could exist between these two companies.

Probably going to take more than a 10 percent premium. If they thought a 10% premium was a good deal, Pacific wouldn’t be ordering more drillships. I think the conversation has to be good for the share price. Still the same, I bet there will be a M&A in Seadrill’s future. Maybe they will buy Vantage.

[QUOTE=dgillum214;97325]Probably going to take more than a 10 percent premium. If they thought a 10% premium was a good deal, Pacific wouldn’t be ordering more drillships. I think the conversation has to be good for the share price. Still the same, I bet there will be a M&A in Seadrill’s future. Maybe they will buy Vantage.[/QUOTE]

I agree with you, I dont think Seadrill is done by any means, Vantage is always an interesting one and has been for the past couple of years, although for Seadrill I see maybe Odfjell or Ocean Rig a more enticing buy for them and one that already has ties to John Fredriksen.