here’s another interesting article

[B]Oil Bust of 1986 Reminds U.S. Drillers of Price War Risk[/B]

By Bloomberg On November 26, 2014

By Asjylyn Loder

Nov. 26 (Bloomberg) — The last time that U.S. oil drillers got caught up in a price war orchestrated by Saudi Arabia, it ended badly for the Americans.

In 1986, the Saudis opened the spigot and sparked a four- month, 67 percent plunge that left oil just above $10 a barrel. The U.S. industry collapsed, triggering almost a quarter-century of production declines, and the Saudis regained their leading role in the world’s oil market.

So while no one expects the Saudis to ramp up output now like they did then and U.S. shale oil companies are pledging to keep drilling regardless, the memory of that bust looms large for American industry executives on the eve of OPEC’s meeting tomorrow. As the Saudis gather with officials from the 11 other OPEC nations in Vienna, analysts are split on whether the group will cut output to lift prices or leave production unchanged to fight for market share with shale drillers.

“1986 was the big price collapse and the industry did not see it coming,” said Michael Lynch, president of Strategic Energy and Economic Research in Wakefield, Massachusetts, who has covered the oil sector for 37 years. “It put a lot of them out of business. You just don’t forget it. It’s part of the cultural memory.”

The Organization of Petroleum Exporting Countries, responsible for about 40 percent of the world’s output, pumped 31 million barrels a day in October, exceeding its official target of 30 million.

Declining Prices

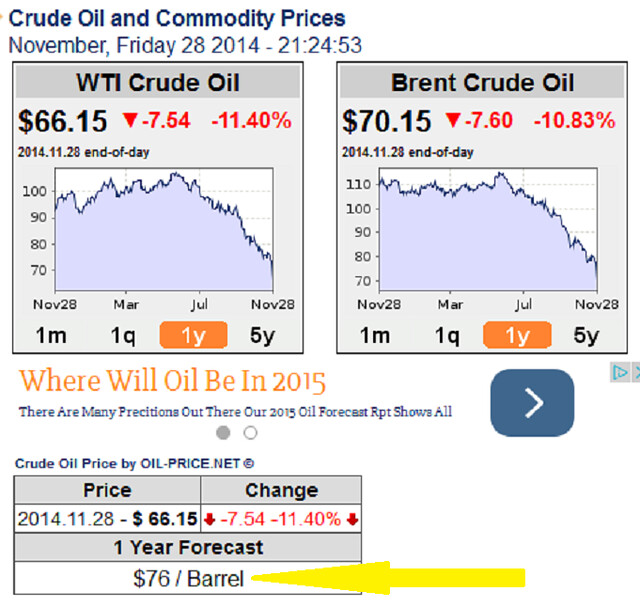

West Texas Intermediate, the U.S. benchmark contract, rose 8 cents from the lowest price in more than four years to $74.17 a barrel in electronic trading on the New York Mercantile at 6:28 a.m. New York time. Brent, the marker for more than half of the world’s crude, gained 19 cents to $78.52.

“Someone has to blink,” said Sarah Emerson, managing principal of ESAI Energy Inc., a consulting company in Wakefield, Massachusetts. “OPEC is saying ‘Does it really have to be us?’”

Saudi Arabia wasn’t the first to blink in 1986. The kingdom had been the world’s swing producer for years, boosting output when prices rose and scaling back when they dropped. As fellow OPEC members pumped more crude, the kingdom’s production fell to 3.175 million barrels a day in 1985 from more than 9 million in 1981, according to data compiled by Bloomberg. That left the country facing a growing budget deficit, according to Daniel Yergin’s Pulitzer Prize-winning book The Prize.

Market Share

In December 1985, Saudi Arabia declared its intention to regain market share and oil prices began to decline, sinking to as low as $10.42 a barrel in March 1986 from a November 1985 peak of $31.72.

OPEC reached a new production-sharing agreement in December 1986. By then, the damage to U.S. producers had been done. Unemployment in Oklahoma rose to 8.9 percent and in Texas to 9.3 percent, compared with the 7 percent national average. Production in Oklahoma fell 8.3 percent in 1986 and 7.1 percent in Texas, according to the Energy Information Administration.

“There was just a flood of equipment on the market,” said James Richie, cofounder of Kruse Energy & Equipment LLC in Odessa, Texas. He has been auctioning oilfield gear for 32 years, and said he conducted 86 auctions that year, more than double the typical number. “In 1986, that equipment was bringing pennies on the dollar.”

The history helps explain why U.S. producers are blaming Saudi Arabia and OPEC for falling prices now and that they say are designed to push them out of business.

Shale Battle

“We’re in a battle with Saudi Arabia in regard to market share versus U.S. shale oil,” Scott Sheffield, chairman and chief executive officer of Pioneer Natural Resources Co., said on a Nov. 5 earnings call.

“What we’re dealing with here is a renaissance that’s going to be very long-lasting here in the U.S.,” said Harold Hamm, chairman and CEO of Continental Resources Inc., in a Nov. 6 earnings call. “And we see OPEC worried about that.”

The Saudis don’t see it that way. Saudi Arabia is committed to seeking a “stable” oil price and speculation of a battle between crude producers “has no basis in reality” Saudi Oil Minister Ali Al-Naimi said at a conference in Acapulco, Mexico, on Nov. 12.

The slump isn’t, regardless of what U.S. producers say, all the fault of Saudi Arabia or OPEC. The group has boosted output by more than 1 million barrels a day since June, led by gains from Libya and Iraq, according to a Bloomberg survey of oil companies, producers and analysts. The Saudis’ contribution was an additional 80,000 barrels. U.S. producers, meanwhile, ramped up output by 621,000 barrels.

Increased Supply

Taken together, the increases are more than enough to supply the 1.1 million barrels a day of worldwide demand growth the Paris-based International Energy Agency has forecast for all of next year.

The glut hasn’t stopped U.S. shale companies from drilling new wells. Top producers including Devon Energy Corp., Continental and Pioneer are planning double-digit production gains next year.

“The U.S. oil industry is blaming the Saudis for a problem that was created here,” Emerson said. “It’s like a gold rush. Everyone is trying to get as much out of the ground as fast as possible.”

Whether this slump proves as calamitous as 1986 depends how long it lasts. Many U.S. producers bought derivatives that protect them against declining prices. That insurance has its limits, and for some companies it will run out after the first half of 2015.

Less Cash

Shrinking revenue will leave less cash to pour into the ground, making some companies vulnerable to a credit crunch. Much of the shale boom is sustained by borrowed money. Total debt for 61 of the U.S.-listed companies in the Bloomberg Intelligence North America Independent E&P Valuation Peers reached $199 billion in the third quarter, up from $184 billion a year ago, according to data compiled by Bloomberg.

“There’s no doubt that you’ll see a lot of people who are vulnerable, especially the smaller players who don’t have deep pockets, and are already deep into other people’s pockets,” Lynch said. “Some of them are already hurting.”

Copyright 2014 Bloomberg.

they should have mentioned the early 00’s as well when R&B/Falcon crashed and burned…grew too fast, took on too much debt and down they went!