When the interest bill equals your income, not there yet but getting there.

Saying that still depends on foreign versus local debt as to how serious it is.

Have you been to China lately?

There is not much “Communism” left, except for the name of the ruling party.

One party Dictatorship, yes, but it is more of a hard nosed capitalist regime than anything like the Maoist regime of the 1950-70s.

I visited China several times during those years (first time in 1960) and many times since the opening up in the 1980s and have seen the development and changes there first hand (last visit 2015).

Maybe your understanding of what is “Communism” is coloured by your ideology?:

https://www.britannica.com/question/What-is-communism

The fundamental issue

The party comes first and there is no second., not changed

the US Government’s budget is absolutely nothing at all like your household budget. There is no interest payment the US government can not pay - in perpetuity - none.

and yet again the economic Armageddon is right there on the horizon - exactly where it has been forever. But it never actually happens - ever.

That is “One party dictatorship”, not “Communism”.

I’d recommend anyone who can visit China. The transportation infrastructure alone is amazing, far beyond anything in the US. Everything is digital, for better or worse. They are a business crazy people that one would never guess have anything to do with communism. BUT you have to be careful what you say about the government lest you be met with silence, kinda like the US. ![]()

Stated plainly without the national government issuing bonds and without the national government also giving investors the money to purchase the bonds through deficit spending, the bond market would not exist. The bond market exists only because the national government causes it to exist. And at least IMO serves no real purpose anymore.

What utopian country do you live in that has no debt ? All countries have debt. Collecting more taxes via tariffs lowers the debt but not if you use it to cut income tax. That is self defeating also as it increases inflation.

One of the countries in the developed world with a low debt and high standard of living is Denmark but taxes are about 47% of GDP as opposed to 27% for the USA. The USA collects less tax than almost all OECD countries primarily because the US taxes income from wages only not income from wealth. Denmark’s citizens get free health care and college as well as good retirement benefits which citizens in the US do not get.

As you have said several times it is a question of “real economic factors of production ( labor, materials, manufacturing capacity)”

I believe the US Government/Treasury have the sense to watch that money is not “printed” without backing of real tangible value, if I understand you (and Greenspan) correctly.

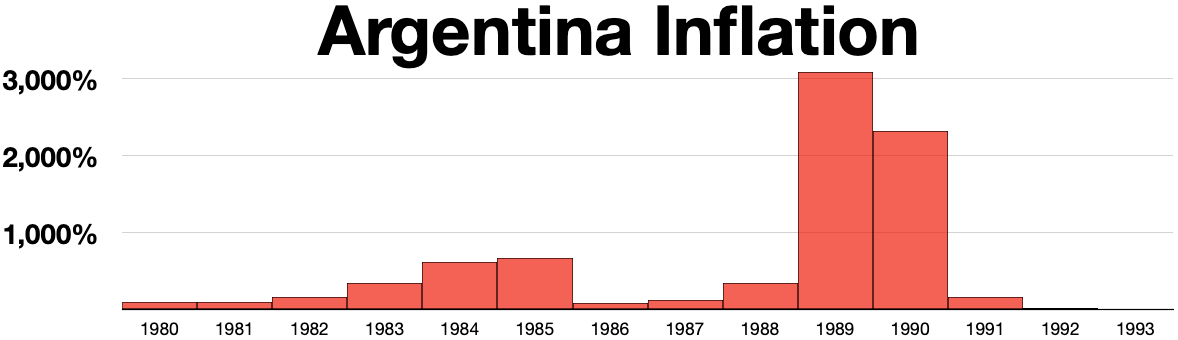

PS> I spent quite some time in Argentina in the years 1982-85 and experienced the runaway inflation that followed from “spending beyond your means”.

At the worst period you only exchanged the cash you expected to need that day.

The official exchange rate for US$ changed by the day. (on the black market sometime by the hour)

Prices in restaurants etc. was in Pesos, which also changed daily,

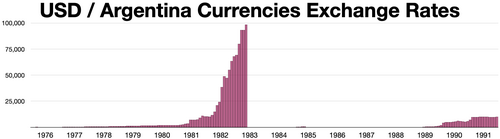

USD / Argentina Currency Exchange Rates *From January 1970 to May 1983: Pesos Ley 18188 *From June 1983 to May 1985: Peso Argentino *From June 1985 to December 1991: Australis

PS> I still have a Peso 1 Mill. bill for remembrance:

I never visited Zimbabwe, but:

exactly - actually a touch more accurately - there must be excess capacity of the real factors of production available in the market to support the money creation. The government should not use deficit spending to compete with the private sector for the real factors of production.

If there is excess capacity - spending puts that capacity to work, increases jobs, those new jobs get paid, they buy stuff now, them buying stuff funds investment by the guys they are buying from and so on and so on.

also what he is saying is there is no risk that the government will run out of money to fund SS - ever - in perpetuity.

The real issue with SS going forward is if there are too many old folks like me - and not enough young folks actually making stuff, doing stuff. There can be a shortage of good/services available in the market for us old folks to buy with our SS checks. That is inflationary - and effectively devalues the SS checks you get.

More interesting the best thing we can do to offset this population dynamic is to open the border to allow in more labor to make more stuff for us to buy.

Maybe this is the answer?:

Not exactly. The SSA is self funded from contributions from payroll taxes paid by the employer and employee from wages up to $176,000/yr. If you get your income from dividends or investments you do not pay anything.

SS and Medicare could easily be funded by lifting the cap on wages to $400,000/yr and indexing it to inflation plus requiring anyone eligible for ss or medicare to continue to pay until age 65 on all income. Over $1 million in interest or investment income a year you pay less than the wage earner %. System is solvent and the rich are still rich.

From The Economist today: (Subscribers only)

that is a political choice. The US government can never ever be insolvent in anything that is denominated in $ - like SS benefits. The US Government has an infinite supply of $. It can send out SS checks in perpetuity.

That is very true as long as the US remains the reserve currency which gets less likely by the day. But the political choice regarding SS should be made so some people would just be quiet about it and stop worrying.

So as long as most trade happen in US$ and not in foreign currency than the US is in control. (??)

What happen if and when the US$ dominance as a trading and reserve currency diminish, or even ends?

Maybe the US economy can survive in isolation for a while, but is that a desirable outcome of the present trade war?

doesn’t matter - you need a paradigm shift. MMT is not something a government “does”. It is not a process or even a choice. It is a framework of economic analysis to explain what “is” happening.

an example - traditional Keynesian economics says if you increase the money supply without an increase in demand - more $ chasing the same goods and services will drive up prices - be inflationary. Makes sense and everyone nods in agreement. MMT say, yea while I hear you, and it sounds like it should work that way - empirically it hasn’t. We have been increasing the supply of money all the darn time in the last 50 or so years, and we have only had 2 periods of real inflation - and neither one was driven by the supply of money. Something must be wrong with your theory. MMT ( by the way an awful name for this idea) attempts to explain what is actually happening - increasing money supply has not caused inflation - why??

Another one - The government borrows - sells bonds - to fund all spending in excess of their revenue. Sure - makes sense - if i spend more than I make I have to borrow - so does uncle sam. Well MMT asks - if you can only buy treasuries with $, and if $ are basically a government liability - how can an exchange of one liability ($) for a different liability ( t bill ) fund anything ?? It can’t - so the Delta between spending and revenue has to be made up in a different way - you just add to the money supply.

And the only way the rest of the world can rid itself of their holdings in $ is to exchange them for goods and services produced by America.

until the USD is not the dominant reserve currency, then USD goes the way of the GBP and the exchange rate changes across the world.